2022-07-02

Managing operations and finance

Operational management and financial management are critical factors in increasing the efficiency and productivity of a company. Active management plays an essential role in making improvements in the goods and services that the company is providing. Effective operational management works by adding worth to products and increasing the level of satisfaction of the customers. (Kaplan & Norton, 2014) . Although N Teck UK Ltd is a reputed company in Edinburg, it still can be affected by many other competitors. The company is highly skilled, and due to customer support, it is providing the customers with a high quality of smartphones. The company does not run on a larger scale, but still, it is providing the customers with all of the required services. The company is now devising different plans to implement in their company. These sets of practices require the implementation of operational management. They deal with the customer satisfaction by providing them with efficient services and high quality material. All of these products are supplied in a limited price range. They have set a financial target to achieve all of the objectives. For this purpose, they need to implement effective strategies for operational management. It will deal with the quagmire Brexit as well that can harm the company somehow. Operative management will highly assist the company in introducing efficient products in an affordable price range. It will also be assisting in making effective decisions and executing different plans in the company. Operational management assists the company in meeting the demands of the customers while making innovations in those products. (Kaplan & Norton, 2014).

Financial management:

For making modifications to the company, products N Teck UK also has to deal with the financial budget and management of this budget to increase the productivity and efficiency of their products. For financial management company has hired finance managers to get over the financial account and to meet the reasonable financial targets that are set by the company. (Kaplan & Norton, 2014) . The company has many departments that work separately to meet the objectives. However, increasing the effectiveness and improvement of products, financial management, and operational management will be playing an essential role. The CEO of N Teck came to know that the percentage to return capital employs is 22% while the profit range that they decided is £7.5m. This range was agreed for the next few years to meet all the financial targets. Financial management will be playing an essential role here; it has to change the entire selling price per unit from £200 to £150. However, their mission is to spend the financial budget on their products to make improvements and to increase the efficiency of those products. Financial management will play an essential role here in controlling all the relevant activities and the funds related concerns. The head of the financial or accounting management will handle all the possible resources and control of the budget. It includes capital budgets, fixed assets, financial decisions, and dividend decisions. The accounting head of N Teck came to know that the fixed cost that needs to make modifications in the smartphones is £2,500,000. This can create challenges for the company, and it is the need of the CEO of hiring efficient and highly skillful to make up improvements in the decided budget of the company. (Kaplan & Norton, 2014).

Difference between financial management and operational management

Financial and management accounting both are the backbone of the efficiency and the progress of a company. They do have different roles in the company, but they work to increase the effectiveness and productivity of a company. In the case of N Teck, they want to increase the efficiency of products, and this can only be possible if they go for implementing different models that aid in increasing the efficiency and the improvement of the smartphones. Management accounting is about dealing with all the internal processes that will be implemented to deal with the increased productivity and efficiency of their products. It is about critically analyzing all the relevant aspects and sets of procedures. While on the other hand, financial accounting is about dealing with the budget of the company and finding out the appropriate way that can frequently deal with the account while increasing the profitability of the organization. Both of these functional operations can benefit N Teck UK in many ways. The need if a CEO is just to find appropriate ways to find out procedures and to devise a path that effectively can make advancements in the company. Both of these managements play an efficient role in dealing with the efficiency, profitability, productivity, aggregation, meeting the standards of customer service, and increasing the effectiveness of the product. Also, financial management will help the companys CEO in maintaining the budget of capital profit.

Models implemented in operational management:

For increasing the productivity and the efficiency of products, the company needs to implement a different set of models into their location. Operational management is full of models that help in the better analysis of processes occurring in the internal structure of the company. This set of research will also help in dealing with proper decisions making that is about to take in the company. Despite this, these sets of models will help in the analysis of different risk management situations. Changing the productivity and making improvements in their smartphone while it is very challenging for N Teck UK because it interferes with the capital and the financial budget of the company. (Kaplan & Norton, 2014) . Applying different models in operation management will help in meeting objectives for which N Teck is working. Following are some models that will be highly assisting for the analyzation of company decisions:

Margin analysis:

This will be highly assisting in making an efficient increase in the betterment and the productivity of the products. Applying this operational model will help the company in increasing the production and effectiveness of their company. This model will help in the calculation of all the financial requirements and optimal sales mix. This managerial technique will be assisting the CEO and finance manager in making efficient decisions for the betterment of the company. The focus of this analysis is to increase production.

Constraint model

Constraint model is a highly efficient technique whose primary concern is to deal with a different set of strategies that work for the identification of bottlenecks. This model is highly effective in maintaining the financial budget of the company and deciding revenue and profits. It will also be highly essential to point out all the factors that can reduce the efficiency of smartphones provides by N Teck.

Capital budgeting:

N Tecks central challenge to maintain a balance in the capital budget. This can only be possible if the company implements different operational models at its place. This operating model will be helping the new finance manager of the company to maintain a financial cost and revenue. This will also help the finance manager to make efficient decisions that can work for increasing the effectiveness of the decisions related to capital budgeting. It will also be analyzing all the budget requirements that can deal with the management of capital expenditures. This model will help the company to calculated net present value and internal rate of return. This calculation will assist the company in making profitable decisions about the company. (Irr et al., 2020).

Investment appraisal techniques:

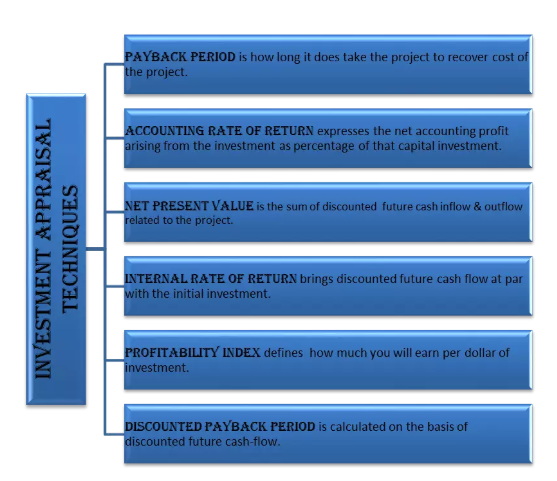

Investment appraisal techniques are those set of strategies that help in increasing the effectiveness and efficiency of the performance due to relative changes in the projects. In simple words, it is about the evaluation of the performance of the company by introducing different sets of techniques. Investment appraisal techniques will be highly essential for the company to evaluate the performance and productivity. (Irr et al., 2020) . The most efficient appraisal techniques include payback period, internal rate of return, net present value, rate of return for accounting, and in the last, it is about the profitability of an index. The CEO of N Teck must implement these techniques into their company, for this can evaluate the relative changes that are about to make in the project appropriately. This set of techniques analyzes the project with every engle and perspective to reach an effective strategy that can benefit the company. N Teck must take advantage of these techniques.

Figure 01: Investment Appraisal Techniques

The above figure describes the functions of all techniques that are about to implement in the company. The payback period will evaluate the period that will be required to make modifications to the company. While on the other hand, the accounting rate of return will be highly beneficial in making financial management effective. It will analyze the capital investment of the company. The cost range with which the company N Teck has to deal with includes £2500000. Using the strategies of net present value and internal rate of return, the budget can be managed efficiently. Other than this, the profitable index and discounted payback period will be highly essential in increasing the effectiveness of the changes that are about to make in the company. The profitable inventory will be deciding the range of profit that the company N Teck will be getting after implementing a new project at its platform. The finance manager of N Teck is supposed to implement all these techniques at their place. The finance manager and accounting head of N Teck can also assume the capital investment and profitability that can increase due to the modifications in the company. This will also protect the company from a risky situation that can cause problems for the company budget shortly. (Irr et al., 2020).

Role of business plan and budget plan in operational management

The business plan plays an influential role in increasing the effectiveness of the projects and in increasing the demand for the products while making modifications in it. It deals with all the operations that are about to implement in the premises of the company. (Irr et al., 2020) . This operational management will devise efficient and alternative ways that can work to increase the chances of business success. The business plan includes all of the internal operations and processes that are used in operational management. It also provides an estimation of all the inventories and budget that is required to implement into the premises of the company. It not only decreases the risk situations, but it also plays a significant role in the effective management of the team employees and an operational plan that can work well. The finance manager must write a business plan that includes all set of inventories and budgets. In the case of N Teck, the finance manager plan a budget plan that can work to increase the profitability and production rate of the company. However, it has many set of problems that must be dealt with. The budget plan of N Teck is somehow suitable for the company, but it requires many modifications that will increase the profitability and production of the company products even more. The budget plan analyzes all the financial factors and financial assets that are present to deal with the changes that are required.

The budget plan is a set of analyses of revenue and profit that can increase the try production rate and the effectiveness of the company. This will be including all of the business factors that can provide the company with financial components. Utilizing this budget plan will be highly assisting the company in making improvements in the products and budget of the company. In the case of N Teck, the account that was provided by the finance manager was on an urgent basis, and it does not implement all the analyzation models into practice. It all the analysis models and appraisal techniques was implemented, then it will surely increase try efficiency and profitability of the company. Also, the set of tables shows the material cost to be high than that of the expected price. There is a need to review this as the increased material costs can decrease the profit and productivity of the company. It can also create risky situations. Every value in the provided data is more than that of the budget presentation. This can make a negative impact on the company, and the company must work to keep a balance between the required and expected budget. (Irr et al., 2020).

Following set of the budget plan will be even more productive for the company:

|

BUDGETARY CONTROL REPORT |

|

|

|

|

|

Date |

28th May |

|

|

|

|

Cist center |

Electronic components (smartphones) |

|

|

|

|

Responsible manager |

|

|

|

|

|

Report cost period |

1st May to 30th May |

|

|

|

|

|

|

|

|

|

|

Production activity |

Budget |

Actual |

Variance |

Variance % |

|

Unit produced |

5000 units |

6000 units |

1000 |

25% |

|

|

|

|

|

|

|

Costs |

Budget (£) |

Actual (£) |

Variance (£) |

Variance % |

|

Materials |

41000 |

42000 |

1000 |

10% |

|

Supplies |

21000 |

21500 |

500 |

5% |

|

Direct labor |

10000 |

10000 |

0 |

0% |

|

Indirect labor |

6000 |

6100 |

100 |

3% |

|

Depreciation |

3000 |

3000 |

0 |

0% |

|

Share pf sales cost |

4500 |

4600 |

100 |

5% |

|

Appropriate overhead |

20000 |

21000 |

1000 |

10% |

|

Total |

105,500 |

70,400 |

2,700 |

20% |

This budgetary report is a modified one and can highly assist in keeping a balance in the available and required debt of budget. Besides, it will help in applying all the budget evaluation and analysis models to make efficient decisions.

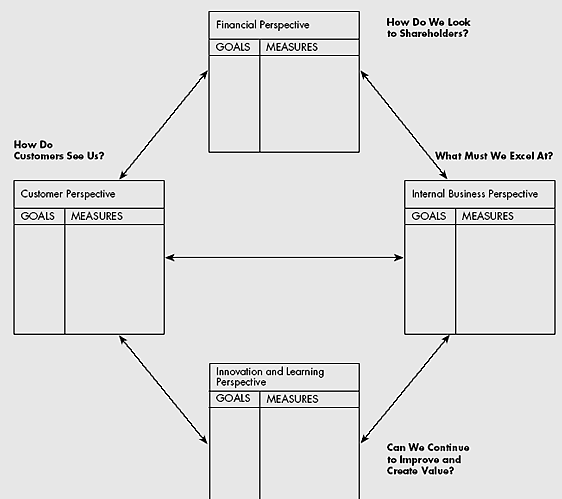

Balanced scoreboard:

This useful strategy is highly essential in inferring the performance of the organization. This strategy highlights all key points that help in increasing the efficiency of the company. In the case of N Teck, there was no balanced scoreboard to analyze and evaluate the performance and innovation of different electronic products. This model highly assists the company in making relative modifications that can increase the productivity and profitability of the company. Also, it measures the financial performance and helps in making efficient decisions that can prove out to be productive and profitable for the company. Also, it measures the effectiveness of the performance. Balances scoreboard is about all the performance measures by setting different goals and actions for which the company is working. Balanced scoreboard talks about the companys condition by viewing it from all relevant perspectives. These perspectives include financial perspective, internal business perspective, customers perspective, and other than this, the innovation and learning perspective. If N Teck implements an effectively balanced scoreboard at their place, it will highly assist them in dealing with the companys objectives. Also, it will analyze all the plans, goals, and measures productively. It will be giving the senior finance manager and CEO of the company to look at the modifications will all the relevant perspectives. It minimizes the loss and makes clear goals about achieving the measures for which the company is working.

Figure 02: structure of balanced scoreboard

Conclusions:

The company N Teck can perform modifications to increase the efficiency and productivity of their products by implementing all the accounting models and operational management strategies. The finance manager must look at the companys with all the perspectives while highlighting every minor budget detail of the company. This will help in keeping a balance in the required and expected budget as well.

References:

anon. (1997): „Writing A Business Plan: Operations And Management“. Entrepreneur. Retrieved am 28.05.2020 from https://www.entrepreneur.com/article/20890.

Irr, Zachariah; Moin; Machio, Nandwa; et al. (2020): „Investment Appraisal Techniques: Payback, ARR, NPV, IRR, PI“. eFinanceManagement.com. Retrieved am 28.05.2020 from https://efinancemanagement.com/investment decisions/investment appraisal techniques.

anon. (2019): „Managerial Accounting Definition and Techniques Used“. Corporate Finance Institute. Retrieved am 28.05.2020 from https://corporatefinanceinstitute.com/resources/knowledge/accounting/managerial accounting/.

Bragg, Steven (2018): „The difference between financial and managerial accounting“. AccountingTools. AccountingTools Retrieved am 28.05.2020 from https://www.accountingtools.com/articles/what is the difference between financial and managerial acco.html.

anon. (n.d.): „Financial Accounting: Explanation: AccountingCoach“. AccountingCoach.com. AccountingCoach Retrieved am 28.05.2020 from https://www.accountingcoach.com/financial accounting/explanation.

anon. (n.d.): „MSG Management Study Guide“. Financial Management Meaning, Objectives and Functions. Retrieved am 28.05.2020 from https://www.managementstudyguide.com/financial management.htm.

Boundless (n.d.): „Boundless Business“. Lumen. Retrieved am 28.05.2020 from https://courses.lumenlearning.com/boundless business/chapter/introduction to operations management/.

Essay Writing Prices